According to the latest findings from TrendForce, the global SSD market returned to normal in 2022 due to a solution to the shortage of master control ICs that had impacted the market in 2021. Despite the normalization of supply, global SSD shipments saw a decline, with only 114 million units shipped in 2022 – a 10.7% decrease from the previous year.

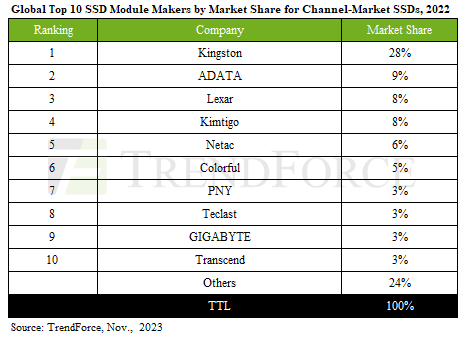

The top three SSD shipping companies in 2022 were Kingston, ADATA and Lexar, with Kingston and ADATA maintaining solid advantages and seeing market share growth compared to 2021. Lexar’s growth was attributed to an aggressive increase in sales in anticipation of an IPO. Kimtigo made significant progress in expanding into the industrial control and OEM markets in 2022, which in turn led to an increase in shipment volume and market share. Netac maintained its competitiveness in the SSD market and secured several government contracts in the enterprise SSD space, keeping its market share and ranking steady year-on-year.

Other changes were noted further down the rankings. Colorful bucked the market trend with an increase in shipment volume thanks to cost advantages in China’s domestic Master Controls and NAND Flash, climbing to sixth place. PNY returned to the top ten and maintained its position despite market declines due to extensive international sales channel development. Teclast maintained its market share in 2021 and climbed to eighth place. GIGABYTE benefited from the gaming market and maintained its ninth place in shipping market share and ranking, while Transcend maintained tenth place and focused on pursuing more profitable niche products in industrial control instead of higher shipping volumes.

In 2022, the top five SSD distribution channels had a market share of nearly 60% and are expected to continue to dominate. Despite the challenges in the market, the top five SSD brands increased their combined market share from 53% to 59%. As global economic conditions remain challenging in 2023, and despite constrained notebook and desktop shipments, module manufacturers have gradually reduced pressure on their inventories through continuous smoothing of high-cost inventory purchases and positioned themselves favorably for price-competitive shipping.

In addition, the overall market situation quickly turned around at the end of the third quarter due to aggressive production cutbacks by NAND flash suppliers, with SSDs being the first to reflect the cost increases and benefiting module manufacturers with lower cost inventories. Large SSD sales channels with significant market volumes and financial resources were able to successfully respond to market fluctuations and capitalize on market opportunities. TrendForce believes that these large SSD companies will only continue to grow in the coming years.

In terms of technology, Chinese PCIe master controller companies such as Maxio Technology are catching up fast and have increasingly mature PCIe control technologies. They are not only shipping mass mainstream PCIe 4.0 products that are compatible with various NAND flash suppliers, but are also aggressively developing and testing PCIe 5.0 products. Cooperation between China’s independent control ICs and module manufacturers is expected to flourish. Facing a volatile market in recent years, Chinese domestic SSD channels are also actively pushing supply chain configuration to push beyond China into international waters. Longsys is leading this push by acquiring stakes in Licheng Suzhou and Smart Modular in Brazil to strengthen downstream module production capacity.

Source: TrendForce

1 Antwort

Kommentar

Lade neue Kommentare

Mitglied

Alle Kommentare lesen unter igor´sLAB Community →