My colleague Usman Pirzada has therefore taken a closer look at the source. After all, there was a 9.8% increase in global GPU deliveries. NVIDIA's deliveries remained largely unchanged for the quarter, while Intel's fell 1.4%. Overall, GPUs shipments increased by 0.6% on a sequential basis (compared to the previous quarter), but were 10.4% lower than in the same quarter of the previous year. Considering that the entire PC market is on the upswing compared to the previous year, the reason for the decline in the dGPU market can only be attributed to the crypto slump and the overstocks, which have had a strong negative impact on the markets. However, it looks slowly like relaxation.

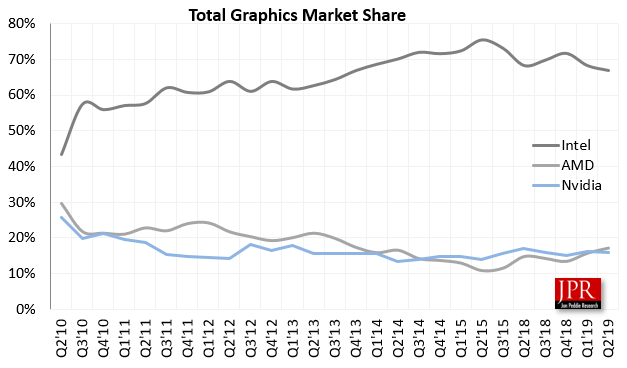

According to Jon Peddie Research, the PC market grew by 3.07% year-on-year, with AMD outstitis for NVIDIA in terms of graphics market share for the first time since the third quarter of 2014. Another very notable statement is that AMD is said to have overtaken NVIDIA in terms of market share. This in turn results from the examination of the charts and, if it is true, would be a situation that one has not had since 2014, i.e. not for 5 years. By the way, this chart graphic comes from a free press release, while the rest of the analysis is behind the usual paywall:

In the second quarter of 19, a total of 76.7 million were reported, according to Jon Peddie Research. units, resulting in a decrease of -8.93 million units compared to the same quarter of the previous year, suggesting that the market is negative year-on-year (for the reasons mentioned above). The results and trends can be summarized roughly:

- AMD's total deliveries increased by 9.85% quarter-on-quarter, Intel's by -1.44% compared to the last quarter and Nvidia's by -0.04%.

- The attachment rate of GPUs (including integrated and discrete GPUs) for PCs was 120% in the quarter, down -10.38% from the last quarter.

- Discrete GPUs were found in 26.95% of PCs, down -1.99% from the last quarter.

- The total PC market grew by 9.25% quarter-to-quarter and by 3.07% year-on-year.

- Desktop graphics add-in cards (AIBs) that use discrete GPUs fell -16.62% compared to the last quarter.

- In the second quarter of 19, tablet deliveries decreased compared to the last quarter.

It is worth noting that the 0.6% increase in the GPU market compared to the previous quarter is a really positive indicator, as deliveries tend to decline seasonally by 2% in this quarter. The report also mentions that while there are some uncertainties in the notebook supply chain, there have been a lot of announcements in return with improvements in design philosophy and internal specifications. Given the presence of Zen and Intel's brand new 10th-place processors. Generation is expected to soon reheat the market in this sector. As the dGPU has become stronger and more energy efficient for mobile devices, these numbers should rise again.

GPUs are usually a perfect leading indicator for the PC market and considering that their share has fallen by 10.4%, this could also be seen as a warning. Fortunately, however, the decline of the PC market is greatly exaggerated and the professional black painters have been talking about it for years without any of them really happening. Considering that the crypto slump is just behind us, the overall result doesn't even look so bad, because many had predicted it much more dramatically.

As Intel prepares to enter the GPU market in 2020, and AMD now seems to be demanding NVIDIA again, the dGPU market will certainly be able to re-launch. Looking at the current course and the statements of distriubutors and traders, NVIDIA's super-offensive does not seem to have been quite as revenue-boosting as hoped. This should also be enough for NVIDIA Herus demand and warning not to rest on the laurels, but also to attack again technologically and priced. RTX on or off, in direct comparison to Pascal, Turing has been able to gain less performance than most expected. Raytracing is certainly important for NVIDIA, but it can hardly compensate for other technological downtime.

Source: Jon Peddie Research via wccftech.com

Kommentieren