While the whole world admires Nvidia for its market capitalization of over $1 trillion at the beginning of the year and praises the company for its prominent positioning in the megatrends of artificial intelligence (AI) and high-performance computing (HPC), there is another company that both benefits significantly from these megatrends and has almost complete control over the production of AI processors. TSMC, according to a report by DigiTimes, is the company making some of the most complex processors for AI and HPC machines ever developed.

Tens of billions of dollars

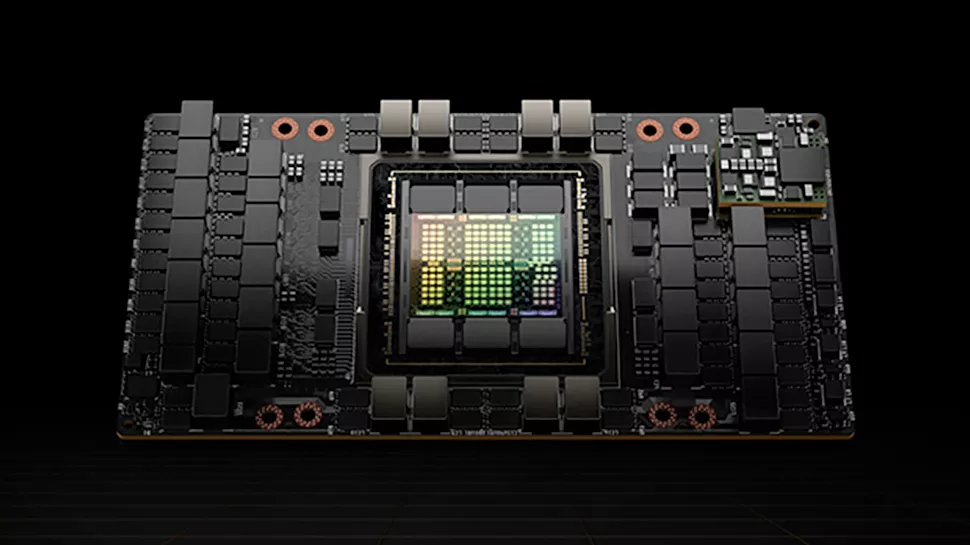

Customers include well-known companies such as NVIDIA, AMD, Intel, Tenstorrent, Cerebras and Graphcore, to name a few. TSMC manufactures Nvidia’s popular A100 and H100 compute GPUs for AI and HPC workloads, as well as their A800 and H800 derivatives for the Chinese market. TSMC also produces AMD’s EPYC CPUs and Instinct GPUs. Even emerging players in AI and HPC like Tenstorrent and developers of innovative products like Cerebras with their wafer-scale processors have chosen TSMC as their manufacturing partner.

Although TSMC does not publish specific figures on revenue from sales of CPUs, GPUs and specialized processors or SoCs for AI, data centers, HPC and servers, it can be assumed that the company generates tens of billions of dollars due to the high silicon requirements of these products. One example is NVIDIA’s GH100 compute GPU with a die size of 814 mm2, while AMD’s EPYC “Genoa” uses 12 Zen-4-based CCD chips, each of which is about 72 mm2.

In total, this requires an area of 864 mm2 of N5 silicon. Although exact revenue breakdowns for TSMC’s competitors, Samsung Foundry and GlobalFoundries, are not available, it is safe to say that TSMC benefits from AI and HPC in general. Compared to these companies, TSMC is clearly ahead as the leading contract chip manufacturer. In particular, TSMC dominates in the supply of AI GPUs, supplying both NVIDIA (which controls over 90 er shipments) and AMD (which controls less than 10%).

AI and HPC are gaining importance for TSMC

TSMC provides a fairly detailed breakdown of its revenue, making clear distinctions between automotive, IoT, smartphones, and high performance computing (HPC). However, this breakdown is not detailed enough to distinguish between chips for AI, HPC, client PCs, servers, and game consoles. Within TSMC, all of these processors and system-on-chips (SoCs) fall into the HPC segment, which is currently thriving.

In 2019, HPC products accounted for 30 of TSMC’s revenue, or $10.389 billion. In the same year, smartphone SoCs accounted for 49 es of TSMC revenue, equivalent to $16.97 billion. However, the share of HPC products in TSMC revenue continues to increase: 33% in 2020 ($15 billion), 37% in 2021 ($21 billion), and 41% in 2022 ($31.11 billion). For smartphone SoCs, on the other hand, the trend is reversed: they will account for 39 es TSMC sales in 2022 (USD 29.59 billion).

While AMD and NVIDIA source large volumes of data center-focused chips from TSMC, Apple remains the largest customer of the world’s leading chipmaker. This is especially true now that the company manufactures both smartphone and PC SoCs, which fall into the HPC category. According to DigiTimes, Apple alone will be responsible for about 23 es of TSMC’s total revenue in 2022.

More chips on the way

The semiconductor industry is experiencing a recovery after a period of downturn, and the growing focus on generative AI is creating new momentum in the market. Nvidia is benefiting from this upswing in AI with its A100/A30/A800 and H100/H800 GPUs, which are manufactured at TSMC. Similarly, AMD is ramping up its orders with TSMC for its upcoming Instinct MI300 series products, which will be mass-produced on TSMC’s N5 node starting in the second half of 2023. According to a report from DigiTimes, Apple, AMD and NVIDIA have also committed to manufacturing future chips using TSMC’s N3 (3nm-class) and N2 (2nm-class) manufacturing technologies.

Source: TomsHardware

2 Antworten

Kommentar

Lade neue Kommentare

Urgestein

Urgestein

Alle Kommentare lesen unter igor´sLAB Community →